HVAC Accounting Best Practices and Useful Tips

By Randy Breneman on Thursday, September 21, 2017Staying on top of your HVAC company's accounting can protect your business and bottom line. Read best practices for HVAC accounting here!

One of the greatest challenges of running a small business is handling aspects of that business that fall entirely outside your area of expertise. You may know everything about HVAC technology and how best to apply it, but that knowledge won’t do you a lick of good when it comes to balancing your company’s books.

If you’re like most HVAC business owners, you got into the business because you’re good with your hands, not because you’re good with numbers. But that doesn’t mean that you can afford to neglect your accounting. In fact, keeping a close eye on your financials is one of the best ways to ensure the long-term success of your business.

Furthermore, the contracting nature of your business adds several wrinkles to the already-complicated process of keeping taxes, wages, and costs in order. Luckily, you can take several steps and use special tools to simplify the process and ensure that your money goes where it should.

By following these tips, you can spend less time pencil pushing and more time using your HVAC expertise to grow your business:

Track Expenses Accurately and Regularly

One of the easiest ways to get ahead of your finances is to track your expenses accurately and on a regular basis. Whether you use QuickBooks, Excel, or good old-fashioned pen and paper, make sure that you’re documenting every penny that goes in and out of your business. This will not only help you stay organized, but it will also make it easier to prepare for tax season.

Use Quickbooks to Manage Your Books

Inuit QuickBooks is one of the most popular accounting software programs for small businesses—and for good reason. QuickBooks can help you track income and expenses, manage invoices and customers, reconcile bank statements, and run financial reports. And if you’re not already using QuickBooks, there’s no need to worry—the learning curve is relatively short, especially if you opt for one of the many QuickBooks tutorials available online. This is a key way to improve your HVAC accounting for your business.

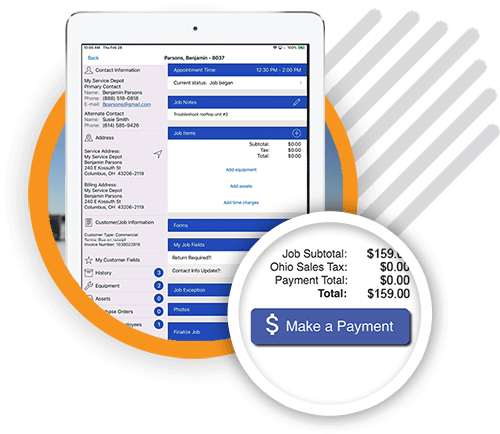

Use HVAC Software to Manage Work Orders and Generate Invoices

If you’re not using HVAC software to manage your work orders and generate invoices, now is the time to start. In addition to saving you time on administrative tasks, HVAC software can also help you stay organized by tracking payments and keeping all of your customer information in one central database.

When shopping for HVAC software, be sure to look for a solution that integrates with QuickBooks so that you can keep all of your financial information in one place. We may be a little bias, but we recommend Smart Service HVAC software!

Monitor Credit Card Statements for Discrepancies

It’s important to keep a close eye on your business credit card statements so that you can catch any discrepancies—including unauthorized charges or fraudulent activity—right away. If you see something questionable on your statement, don’t hesitate to reach out to your credit card company or bank for assistance.

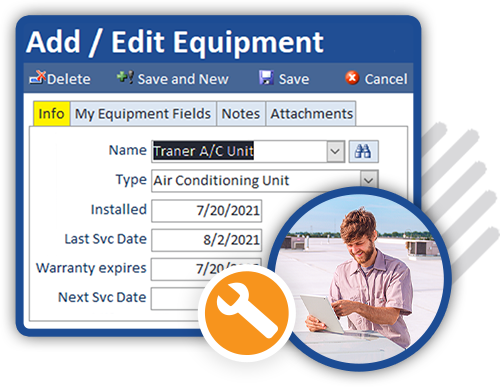

Track Company Equipment and Inventory

Any business that owns equipment needs to track its inventory, and Quickbooks is one of the most popular software programs for doing just that. Quickbooks can help you keep track of what equipment you have on hand, as well as what needs to be ordered.

This is especially important for businesses that rely on equipment to function, such as HVAC companies. Smart Service software is an add-on to Quickbooks that can be used to track company equipment and inventory. This program is specifically designed for businesses that service and repair HVAC systems.

In addition to tracking equipment, Smart Service can also help you manage your appointments and customers. By using Quickbooks and Smart Service, you can ensure that your business always has the right equipment on hand to get the job done.

Hire an outside CPA firm if you cannot manage your books internally

This is a great way to outsource some of the work so that you can focus on growing your business. More on this later.

Do not delay in processing receipts, invoices, rebates, or bills

This will help you stay organized and avoid any late fees or interest charges.

Trust: Hard to Gain, Easy to Lose

The unfortunate reality of any employee-based business is that owners can inadvertently open themselves up to theft by entrusting their company’s assets to seemingly trustworthy associates. HVAC contracting businesses stand doubly at risk thanks to the nature of the industry. Every day, you send your technicians out into the field in specialized vehicles loaded with expensive equipment, simply trusting that all those expensive assets will return intact.

If you give your technicians credit cards to purchase fuel while they work out in the field, you could be writing a blank check for them to cash in at their leisure. Accounting mistakes, oversights, or abuses can harm your business in many ways. Improper bookkeeping can lead to audits, unchecked rebates can lead to lost profits, and unwatched expenses can destroy your bottom line.

None of this is to say that you should be distrustful of your employees or associates. However, you should always keep a close eye on your assets and hire skilled professionals to handle your books. You can avoid some mistakes by simply keeping a closer eye on expense statements, catching discrepancies as they happen.

Consider Hiring a Professional CPA

For more complicated situations, hiring a professional CPA firm to handle books represents a viable solution. You know that ordering cut-rate materials or equipment will only damage your business down the line, so why would you take a chance with cut-rate financial oversight and management?

Incidentally, there are benefits to hiring a professional CPA beyond that of lessening the risk of an audit. When it comes time to handle the year’s taxes, you’re going to want to make sure that you receive every break that you can possibly get.

With the archaic and complicated nature of the tax code, those breaks can remain hidden from all but the most experienced accounting professionals. A respected and established CPA may represent a significant cost to your business. The savings that a CPA brings in terms of finding breaks that less-experienced accountants may miss may make up the difference.

QuickBooks & HVAC Software

That said, there are a number of reasons why you might not want to bring in an outside party to handle your finances. Perhaps your business isn’t yet big enough to justify that investment. Perhaps you feel confident enough in your accounting abilities to balance the company’s books on your own. In these cases, making use of an accounting software solution like QuickBooks to help organize your finances and streamline your operations makes a lot of sense.

Far from simple ledger software, QuickBooks can—among other things—track income and expenses, maximize tax deductions, invoice and accept payments, and manage your bills. The program also allows for easy sharing of your books, which allows for seamless collaboration between you and your accountant should you decide to hire one in the future.

One of the most exciting aspects of QuickBooks? The number of HVAC software programs that can pair with it. As an HVAC software for QuickBooks, Smart Service allows you to take control of your HVAC business in ways that you might not have thought possible.

Time-consuming tasks prone to error—like scheduling, routing, and dispatching—are made worlds more efficient and accurate by this comprehensive and easy-to-use software solution. Billing mistakes that can haunt your business get eliminated with the integration of digital work orders that create invoices within QuickBooks.

These represent but a few of the ways HVAC business software can streamline and simplify your operations. Many more HVAC software features have made it an indispensable tool for HVAC business owners everywhere.

More Useful HVAC Accounting Tips

1. Keep a detailed, up-to-date ledger of all your business expenses and income

As a business owner, it is essential to keep detailed records of all your expenses and income. This will help you stay organized and ensure that you are able to track your finances. A ledger is a great way to do this, as it provides a clear and up-to-date record of all your transactions.

Ledgers can be used to track both expenses and income, so you can see where your money is going and how much profit you are making. You can also use a ledger to track customers or clients, so you can see who owes you money and who has paid their invoices. Keeping a detailed ledger is an essential part of running a successful business.

2. Separate personal and business finances as much as possible

As a general rule, it is best to separate personal and business finances as much as possible. This can help to prevent financial problems down the road and make it easier to manage your money.

There are a few different ways to do this:

- You can open separate bank accounts for your business and your personal finances. This will help you to keep track of your money and ensure that it is being used for the right purposes.

- You can also use separate credit cards for business and personal expenses. This can help you to keep track of your spending and avoid getting into debt.

- Finally, you should keep detailed records of all of your business expenses. This will help you to claim deductions on your taxes and track where your money is going.

By keeping your personal and business finances separate, you can maintain a professional image and avoid potential financial problems.

3. Make sure you’re taking advantage of all the tax deductions available to you

When it comes to taxes, there’s no such thing as too much information. The more you know, the better equipped you’ll be to take advantage of all the deductions and credits available to you. That’s why it’s important to do your research and make sure you’re taking advantage of everything that’s available.

For instance, if you own a business, there are a number of tax deductions that can save you money. From office supplies to travel expenses, there are numerous ways to reduce your tax bill. So, before you file your return, be sure to do your homework and take advantage of all the tax deductions and credits that are available to you.

4. Have an emergency fund to cover unexpected costs

Having an emergency fund is one of the smartest things a business owner can do. Unexpected expenses are always popping up, whether it’s a broken piece of equipment or an unanticipated increase in rent. Having a pool of money to cover these costs can take a lot of stress off of the business owner and help keep the business afloat during tough times.

Additionally, having an emergency fund gives businesses a competitive advantage; owners who have prepared for unforeseen costs are more likely to weather financial setbacks and maintain stable operations. In short, an emergency fund is an essential tool for any business owner who wants to be prepared for whatever life throws their way.

5. Use cloud-based accounting software for easy access and organization

Cloud-based accounting software is a great way to keep your finances organized and easy to access. With cloud-based accounting, you can access your financial information from anywhere, at any time. Plus, cloud-based accounting software is usually much easier to use than traditional accounting software.

That means you can save time and get your finances in order more easily. And, because cloud-based accounting is often more affordable than traditional accounting software, it can be a great way to save money, too. So if you’re looking for an easy, efficient way to manage your finances, cloud-based accounting software is a smart choice. Smart Service Cloud and Quickbooks Online are both perfect examples of this!

Protect your HVAC Business With Better Accounting Practices

The thought of balancing your books can become an intimidating one, especially when doing so means taking into account all the factors that can affect the finances of your HVAC business. The risk of letting that responsibility fall by the wayside, however, is well-established. At best, you could lose out on deductions and on opportunities to make your business more efficient; at worst, accounting mistakes could cost you your livelihood. Avoid that risk by taking hold of your finances today!

If you enjoyed this article, be sure to check out more of our content on the Smart Service Blog. You can also visit our Facebook page and follow for daily articles and other related content.